Introducing a new prop firm that’s offering some unique opportunities for futures traders. It’s called Savius Trading, and it’s focused on direct-to-live accounts, so there’s no evaluation phase or simulation requirement to get started. Here’s a rundown of what makes Savius different, why I’m trying it out, and how you can get involved.

Why Savius Trading?

Savius is a European-based prop firm out of Switzerland with Italian ownership, established in 2014. They’ve primarily served European traders until now but are expanding to give traders worldwide an option to jump straight into live trading. With a solid 4.6 rating on TrustPilot, Savius has established itself as a reliable choice in the prop firm market. Their focus is on providing a clear path to live trading with payouts starting just 10 days in, and they even allow trading treasuries and the DAX (German stock index).

Key Features of Savius Trading Accounts

1. Direct-to-Live Accounts

- Savius offers direct-to-live accounts, eliminating the challenge and evaluation phases entirely.

- You can hold up to five accounts at a time, and your first payout is available after just 10 trading days. Subsequent payouts require only five days of trading.

2. Profit Targets and Drawdown Limits

- Each account comes with a 5% maximum drawdown and a 7% profit target, so you can withdraw once you reach that 7% threshold.

- The available account sizes are 25k, 50k, 100k, 150k, and 300k, giving traders a range of options depending on their funding needs.

- Savius uses a 20% consistency rule, but they allow traders to trade without a daily loss limit unless they prefer to add one (an optional feature).

3. Payout Flexibility and Add-ons

- For a small additional fee ($113), you can enable expedited payouts, allowing withdrawals within 48 hours after a request.

- Without the add-on, payouts are made within 10 days.

4. Platform Options

- Savius accounts are compatible with Quant Tower and Volumetrica, which both support DX feed data. While platforms like Tradeovate aren’t yet supported, Quant Tower works seamlessly for futures trading.

Getting Started with Savius Trading

Savius offers several account sizes, each with its own profit targets and payout limitations:

| Account Size | Profit Target | Max Contracts | Payout Limitations |

|---|---|---|---|

| 25k | $1,750 | 2 Minis | $1,000 |

| 50k | $3,500 | 5 Minis | $2,000 |

| 100k | $7,000 | 10 Minis | $2,700 |

| 150k | $10,500 | 20 Minis | $4,000 |

| 300k | $21,000 | 40 Minis | $5,400 |

Your profit targets are slightly higher than the drawdown limits, acting as a built-in buffer, and consistency rules aim to curb excessive flipping, helping you trade with a disciplined approach. For instance, on the 25k account, you’ll need a minimum daily target of $75 to count a day toward your payout requirements.

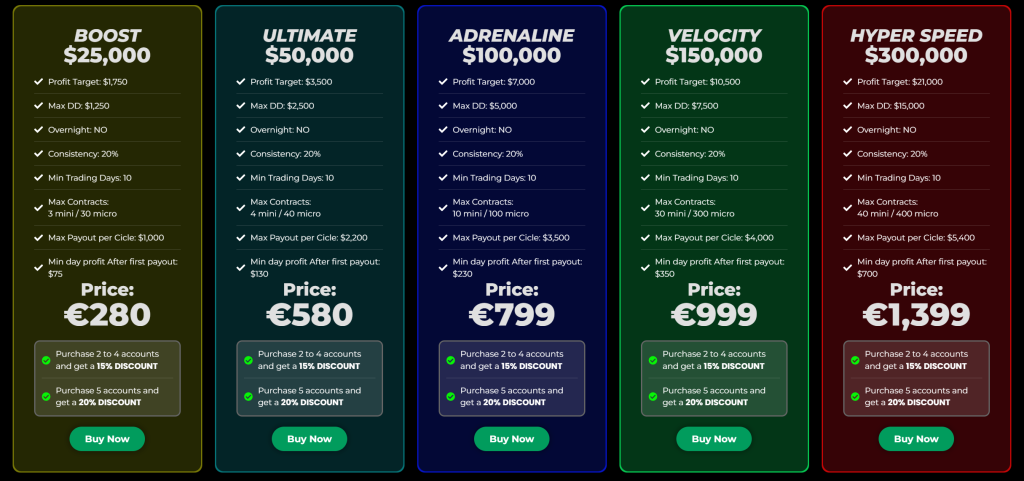

Discount Options and Pricing

- 25k Account: €280

- 50k Account: €580

- 100k Account: €799

- 150k Account: €999

- 300k Account: €1,399

If you purchase multiple accounts, you’ll receive even higher discounts—up to 25% off for five accounts. Using my referral link will automatically apply the extra 5% discount, and you’ll find it in the description below.

Final Thoughts and Future Plans

With Savius entering the market, traders have more opportunities for direct-to-live accounts, Here’s to more options and better competition in the prop trading world! and I’m looking forward to seeing how they measure up. If you give Savius a try, let me know in the comments.