Savius Trading offers an intriguing option for traders looking to bypass lengthy assessment phases by directly accessing funded accounts. With Savius’ Instant Funding program, traders can skip the common “challenge” phase typical of many other prop trading firms, allowing for immediate access to substantial capital. Here’s a detailed look at the key features, benefits, and potential drawbacks of Savius’ Instant Funding accounts.

Key Features and Benefits

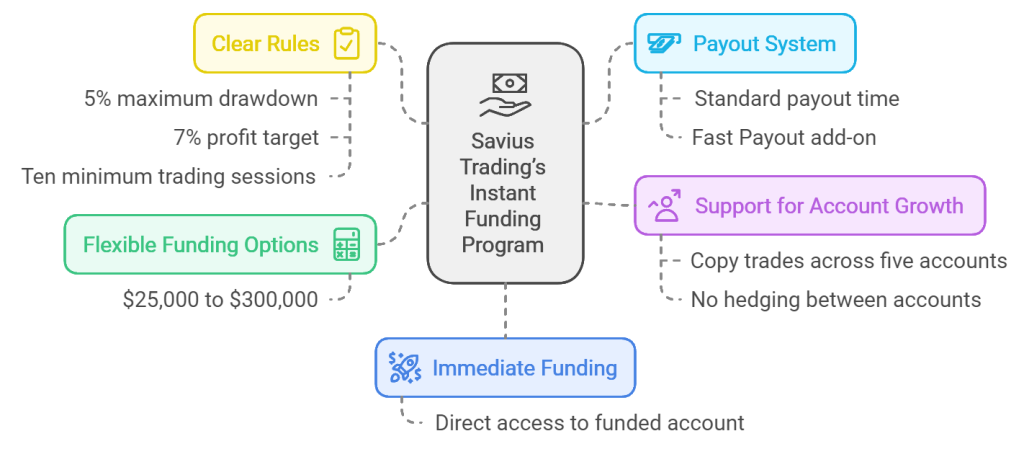

- Flexible Funding Options:

Savius offers multiple account sizes—ranging from $25,000 to $300,000. This flexibility can be appealing to traders at various levels, enabling them to choose a starting point that matches their comfort and experience level. - Immediate Funding and No Challenge Phase:

For traders eager to start, Savius’ Instant Funding provides direct access without an initial evaluation period. The benefit here is clear: instead of trading in simulated or restricted accounts, traders can begin with a funded account and have the potential for real earnings right away. - Clear Rules and Low Requirements for Consistency:

Savius aims to promote consistency with simple but structured rules:

- A maximum drawdown of 5% of the account balance, which is “trailing” (adjusted upwards with profits).

- A 7% profit target before a payout can be requested.

- Ten minimum trading sessions to establish trackable performance and avoid overly aggressive trading strategies.

- Payout System and Fast Payout Add-On:

Once the 7% profit target is reached, traders can request a payout. An optional “Fast Payout” add-on allows payouts to be processed within 24–48 hours, as opposed to the standard processing time of up to 10 days. This speed can be particularly beneficial for traders who rely on consistent liquidity. - Support for Account Growth and Copy Trading:

Savius allows traders to copy trades across up to five owned accounts, which is advantageous for traders managing multiple portfolios. However, hedging between accounts is prohibited, aligning with the firm’s emphasis on risk management.

Account Structure and Costs

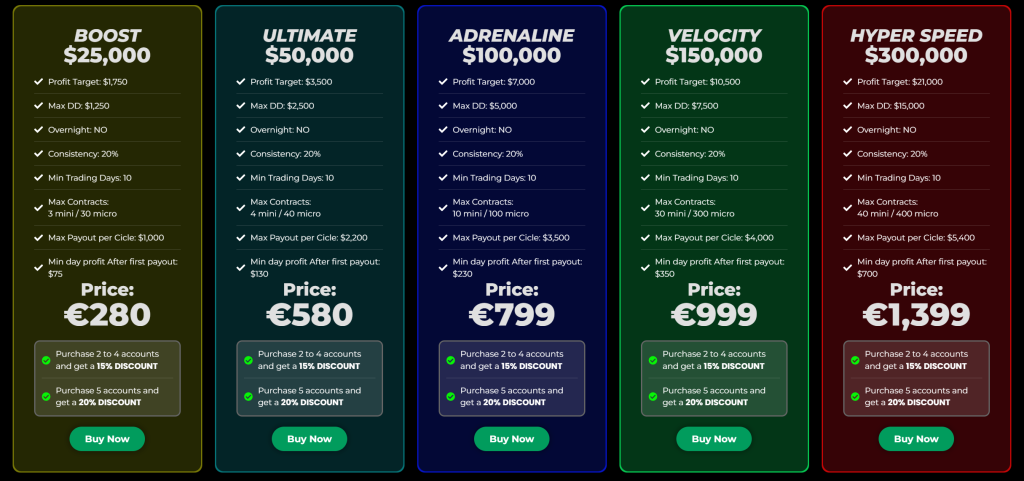

Each account level has specific parameters regarding maximum contracts, drawdown limits, and payout amounts. For example, a $25,000 account allows up to three mini or 30 micro contracts and offers a payout cap of $1,000 per cycle, while a $300,000 account allows for much larger contract sizes (up to 40 mini or 400 micro contracts) with a higher payout limit of $5,400 per cycle. Account costs vary from €280 for a $25,000 account to €1,399 for a $300,000 account, with bulk discounts available for purchasing multiple accounts.

Potential Drawbacks

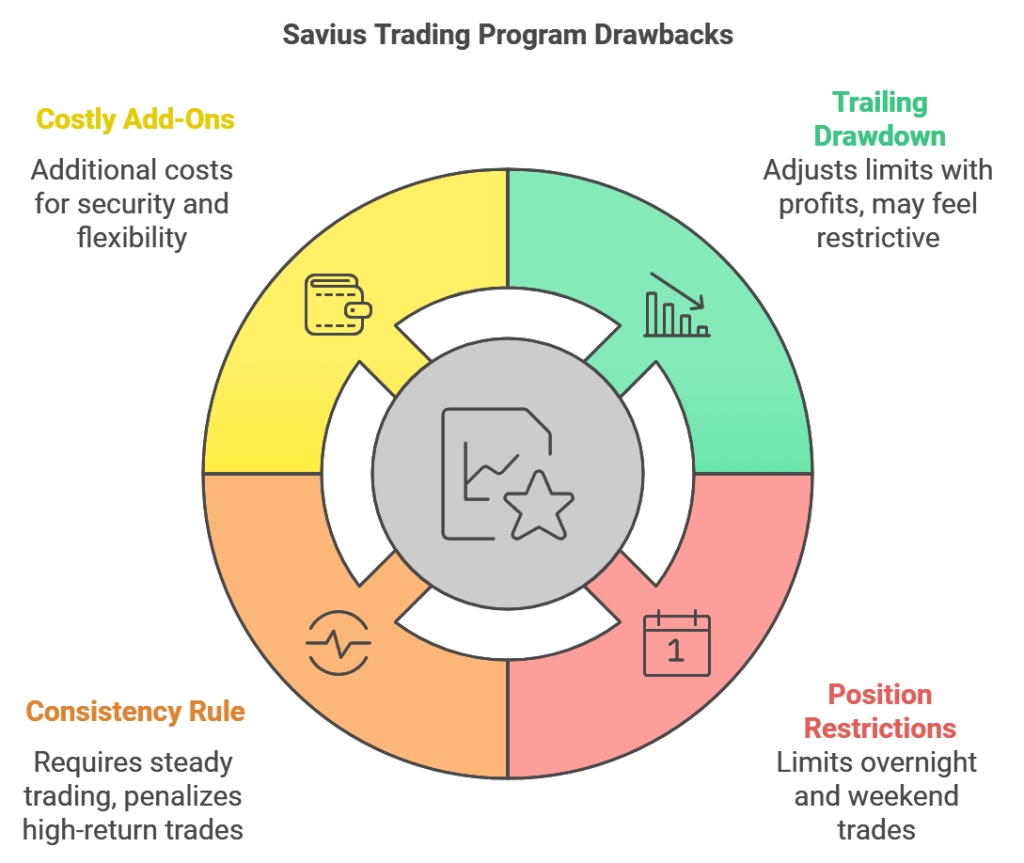

- Trailing Drawdown:

The trailing drawdown mechanism means that drawdown limits adjust upwards as profits increase. While this promotes conservative risk management, it could feel restrictive for traders accustomed to fixed drawdown models. - Overnight and Over-Weekend Restrictions:

Savius prohibits overnight and over-weekend positions, which may be limiting for traders who employ longer-term strategies. Day traders and scalpers will find this structure more suitable, while swing traders might feel constrained. - Consistency Requirement:

The 20% consistency rule, which requires traders to avoid over-relying on single, high-profit trades, adds an additional layer of challenge. Although intended to ensure steady trading behavior, it could penalize traders who encounter occasional high-return trades that make up a large portion of their gains. - Costly Add-Ons:

Add-ons, such as the Fast Payout (€110) and Daily Drawdown Protection (€80), can add up, especially for traders operating on a budget. While these options provide additional security and flexibility, they represent extra costs that traders need to weigh carefully.

Who is Savius Best For?

Savius’ Instant Funding model is designed with experienced day traders in mind—those comfortable with strict drawdown limits, consistency checks, and daily session requirements. It’s especially ideal for traders seeking a fast-tracked entry to prop trading without an assessment phase. However, those with a preference for swing or position trading might find Savius’ approach less aligned with their strategies due to overnight restrictions.

Final Thoughts

Savius Trading’s Instant Funding accounts provide a unique opportunity for traders looking to immediately access funded capital, but with strict conditions that prioritize risk management and consistency. For traders who can navigate these rules effectively, Savius offers a straightforward path to earning potential. With flexible account sizes, a structured payout system, and options for faster payouts, Savius has created a robust funding option with appeal for the right trader profile. However, it’s essential to consider the added costs of add-ons and the restrictive nature of trailing drawdowns before diving in.

If you’re a disciplined day trader looking to jumpstart your trading career, Savius Trading’s Instant Funding account could be a strong contender in the prop trading space.